With 30 June fast approaching its time to review your superannuation position to see if there are any potential strategies that you might be able to take advantage of.

Contribution Caps

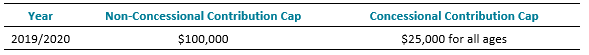

There are limits to the amount you can contribute into superannuation per year. These caps are:

Non-concessional contributions are after-tax contributions including spouse contributions and contributions made under the Super Co-Contribution Scheme. Non-concessional contributions were previously known as undeducted contributions.

Concessional contributions are before-tax contributions and include your employer’s compulsory contributions, additional employer contributions, and any amounts that you salary sacrifice into superannuation.

Tax Deductible Superannuation Contribution

From 1 July 2017, individuals eligible to make contributions to superannuation, have been able to claim an income tax deduction for personal superannuation contributions up to the concessional contribution cap of $25,000.

Note the $25,000 cap also includes your employer compulsory contributions.

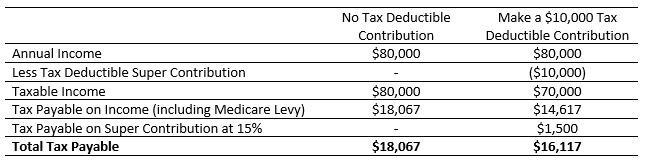

If you have surplus cash funds available in your own name, you could make an additional contribution and claim a tax deduction for the contribution in your tax return. The additional contribution would result in a reduction in taxable income and therefore personal income tax liability. Please see the below example based on taxable income for the year of $80,000.

Tax Saving by making a $10,000 contribution $1,950 ($18,067 – $16,117)

Catch Up Contribution

From 1 July 2018, individuals with superannuation balances of less than $500,000 will be able make additional concessional (before-tax) contributions up to 5 consecutive years’ worth of unused cap. Only unused amounts accrued from 1 July 2018 can be carried forward and utilised as catch-up contributions. Hence the maximum catch up contribution that you could use this financial year is $50,000.

This could be a good strategy if your income was higher or you made a capital gain and have unused contributions from 2018/2019.

Superannuation Co-Contribution

Superannuation co-contributions help eligible people boost their retirement savings. If you’re a low or middle-income earner and make personal (after-tax) contributions to your super fund, the government may also make a contribution (called a co-contribution) up to a maximum amount of $500.

The eligibility criteria is as follows:

- Your total income is equal to or less than the lower threshold of $38,564 for the 2019/2020 financial year;

- 10% of your assessable income must come from employment-related activities, carrying on a business, or a combination of both;

- You were less than 71 years old at the end of the financial year;

- You lodge a tax return; and

- You make personal contributions of $1,000 to your super account.

If you satisfy the above criteria we would recommend a $1,000 contribution before 30 June 2020. The result is – contribute $1,000 and get $500 – that’s a 50% guaranteed return! If your eligible income is above the lower threshold of $38,564 but below the upper threshold of $53,564 for the 2019/2020 financial year, and you satisfy the above criteria, you will be eligible for a reduced Government Co-Contribution.

You don’t need to apply for the super co-contribution. When you lodge your tax return, the ATO will determine if you’re eligible. If the super fund has your tax file number (TFN) the payment will be made directly to your superannuation account.

Spouse Contribution

If you have a spouse who earns less than $37,000 and you make a spouse super contribution of up to $3,000, you can claim a personal tax offset of 18% of the contribution up to the maximum rebate of $540. The tax offset phases out when your spouse earns $40,000 or more.

Your spouse’s income includes their assessable income, reportable fringe benefits and any reportable employer super contributions such as salary sacrifice.

Non-Concessional Superannuation Contribution

Non-concessional contributions are personal super contributions made from your own after-tax monies. You don’t claim a tax deduction for these contributions, and they are capped at $100,000 each year. You must be under 65, or if aged between 65 and 74, meet the work test to qualify. And your total super balance (as at 1 July 2019) must also be less than $1,600,000.

If you are under age 65 (technically aged 64 or less at 1 July 2019), then you can access the “bring-forward rule” which allows you to make up to three-years’ worth of contributions or $300,000 in one go. A couple could potentially contribute $600,000 into super. Ability to access this is further limited by your total super balance (under $1.4m full amount; $1.4m to $1.5m $200,000; $1.5m to $1.6m $100,000).

Superannuation is a tax effective investment vehicle, if you have surplus cash this may be a good strategy for you to consider especially in the lead up to retirement.

Minimum Pension Drawdown

You are required to drawdown a minimum amount of pension each year to satisfy legislative requirements. This amount must be withdrawn before 30 June.

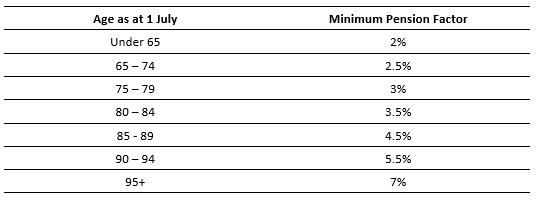

The Government reduced the minimum pension drawdown for 2019/20 and 2020/21 to assist retirees following the Covid-19 pandemic. The minimum drawdown factor is determined by your age and is calculated each year. The table below illustrates the reduced minimum pension factors for each age group for the 2019/2020 financial year: