For families and individuals, Income Protection can be a saving grace. None of us want to imagine misfortune befalling us, yet it can – and does – happen. Hence we all need to be prepared.

The Global Financial Crisis forced us all to take a long hard look at our lives and to reassess our needs and priorities to prepare for the unthinkable – being made redundant. Most of us will have known someone at some time that has been told they are no longer employed.

One of the most common questions – and misunderstandings –is whether or not Income Protection insurance covers redundancy. We have illustrated below the answer to this question and straighten out any misconceptions so you can be prepared for whatever risks can happen to you.

Redundancy – it could happen to you

There is no wonder people are worried about job losses and unemployment in Australia today. The unemployment rate is currently 6.3% – nearly the highest it has been in 10 years. A number of Australian industries, including mining and car manufacturing, have suffered as a result of the GFC.

Sure, it may be the big businesses that are struggling (though the small ones are too!), but the effects of lost revenue ripple down the employee chain to the very last person. Factories shut down and jobs are shed in a bid to save the company. But who’s there to save the individuals who have been cropped from the employee list? And what about their dependents – spouses and children? It is easy to assume that Income Protection would cover you when you lose your job. But it’s not as simple as that.

Does Income Protection cover redundancy in Australia?

The simple answer to this question is no.

Income Protection in Australia provides cover if – and only if – you are unable to work because of a serious illness or injury. In fact unlike in the United States and the United Kingdom, it is against the law in Australia for life insurers to provide unemployment cover in their policies.

If you’re looking at getting income insurance, you should be aware of this important fact: Income Protection does not include redundancy cover. Nor will you be covered if you are fired or if for some reason you have to leave work voluntarily. Don’t be led astray by buying a Life Insurance policy that does not cover everything you think it does.

Can you receive any benefits in Australia if you’re made redundant?

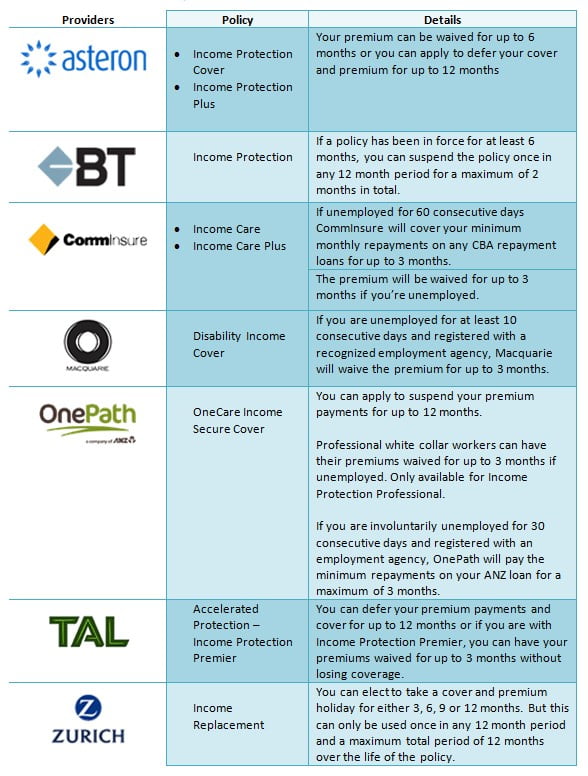

While you cannot receive payments from Income Protection cover if you lose your job, there are alternative forms of support some Australian insurance providers offer. These include:

- A premium waiver. A number of insurance companies will waive the premium payments of your insurance policy if you are made redundant and so are temporarily unemployed. The premium waiver is usually only available for a certain number of months and is applied only after you have shown evidence that you’re actively seeking alternative employment.

- An unemployment benefit. If you’re insured with the same company that provides your mortgage, you may have your mortgage repayments covered if you’re involuntarily unemployed for a certain amount of time.

Below are some Life Insurance companies and the features they offer in case of redundancy:

What else can I do to make sure I’m protected?

Just because you won’t be insured for redundancy it doesn’t mean there is no way you can prepare yourself for possible unemployment. Here are a number of things you can do to make sure your income is protected should you be facing redundancy:

Save

It may sound obvious, but it really is that simple. Put aside a bit of your money in case of an emergency. Sure, your savings aren’t inexhaustible and may dwindle quickly when you have to dip into them. But the more you save, the less stress you face if you lose your job.

Get proactive

Reassess your resume, consider a career change or build up your skill set. It doesn’t matter how you go about finding a new job, as long as you remain proactive about it. With a fresh resume and a positive attitude, it will only be a matter of time before you find a new job. For all you know, the redundancy may lead you down a whole new path that will reshape your life!

Understand employee redundancy packages

If you are made redundant, you may be eligible for a redundancy package. This is usually a payout based on your base rate of pay for a certain amount of time. Your redundancy pay entitlement can be calculated on the Australian Fair Work website.

Source: Fair Work Ombudsman

Enter a government employment stream

Some people are reluctant to turn to the government for help when they need it most, but it is still important to know what you may be entitled to. A bit of temporary financial help from the government may be the difference between meeting your basic living expenses or not. The Australian Government offers financial help under the Newstart scheme to those actively pursuing work. The scheme covers you financially during the period in which you are unemployed as you search for alternative work.

We are here for you and everything will be all right.

We understand that you want to have all bases covered so that you and your family are as protected as you can be against all possible risks. Unfortunately, there are some things you simply can’t be covered for in Australia. But if you do your research and are prepared, you can always find ways to make things easier for you during what could be the most difficult time of your life. At Level One, we also aim to make things easier for you, so if you have any concerns or simply want to know more, contact us today.