Markets

- Market Performance – ASX200 dropped 3.7% in September but rose 1.9% in October.

- Sector Performance – IT up 9%, financials up 6%, consumer staples up 5%.

- Global – in the US the S&P500 index fell 3.8% in September and another 2.7% in October.

- Gold – dropped a further $5.00 to $1,881.

- Iron Ore – dropped $5.00 to $120/ton in September and $2.00 in October to $118/ton.

- Oil – fell to US$40.95/bbl down $4.33 in September and $3.49 in October to US$37.46/bbl.

Property

- Housing – national prices dropped 0.4% in August and 0.2% in September but rose by 0.2% I October. All capital cities except Sydney and Melbourne rose.

- Auction Clearance Rates – Sydney’s auction clearance rate was a healthy 76% on 7th November.

- Residential Building Approvals – rose a strong 15.4% in September.

- Finance – new home loans boomed 12.6% in August and are up 19.3% year on year.

Economy

- Interest Rates – were cut to 0.10% on 3 November.

- RBA – announces it will buy $100 billion of government bonds to lower rates for longer.

- Retail Sales – jumped in June by 2.7%m/m and a further 3.3% in July and now 4.2% in August.

- Bond Yield – Australian 10 year government bond yields fell to 0.79% in September but rose slightly to 0.83% in October.

- Consumer Confidence – Westpac Melbourne Institution consumer sentiment surged 18% in September and 11.9% in October.

- Exchange Rates – the Australian Dollar fell again against the US Dollar to AUD70.2 cents.

- US Unemployment – was 6.9%. The number of long term unemployed (those jobless for 27 weeks or more) increased by 1.2million to 3.6 million accounting for 32.5% of the total unemployed.

- Chicago Purchasing Managers Index (PMI) – remained strong in October at 61.1 indicating a strong economy bouncing back from COVID-19 lows.

- Chinese Economy – remains strong. China’s global surplus fell in September to US$37 billion from highs of US$58.9 billion in August and US$62.3 billion in July. Chinese exports to the US continued to grow over the past year despite US trade tariffs being imposed by the Trump administration.

- US Employment – rose by 638,000 in October.

- Global COVID-19 Cases – continue to rise with new cases rising to a record 552,000 on 28th October. France, German, Italy and Spain have led the way with nation-wide or full mobility restrictions. Many other European countries have implemented softer mobility restrictions.

Comment

Interest Rates

While the RBA lowered the official cash rate to just 0.10% in their November meeting, the more important news was that the RBA will spend $100 billion buying Australian Government Bonds going forward.

Importantly this measure is designed to keep rates lower for longer and hence this action should see a prolonged period of very low rates.

That period is thought to be 3-5 years.

In addition to this measure the Reserve Bank has reduced the rate of interest it will charge the large trading banks under its Term Funding Facility (TFF) which was established in March 2020.

The rate was lowered to just 0.1%. So under this facility trading banks can access loan funds from the RBA for just 0.1% for eligible borrowers.

As a result, we saw last week the CBA come out with a fixed home loan rate offering of 1.99% which was quickly followed by an announcement from Westpac at 1.89% for their fixed rate home loan facility.

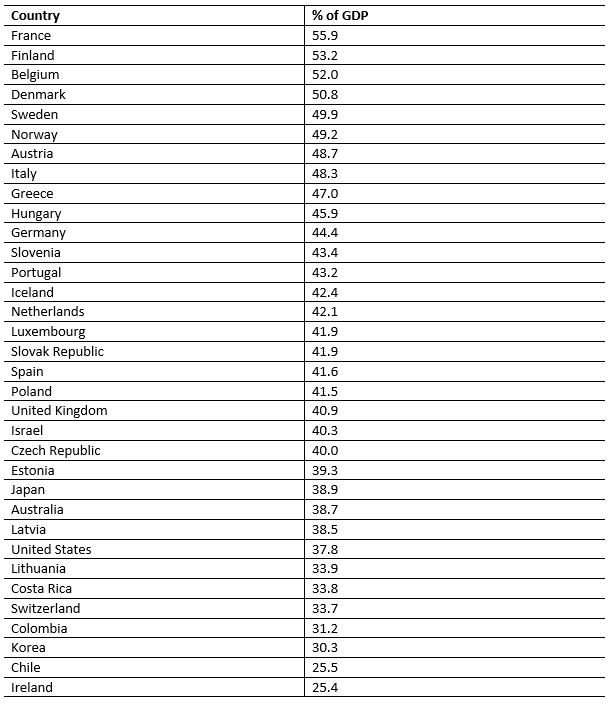

Socialism v Government Support

The table below gives you an idea of government spending as a percentage of GDP by country.

As governments borrow more and more to support economic growth the more likely we are to drift into Socialism by default as we expect government to solve all our problems and to keep the economy growing at all costs.