Markets

- Market Performance – ASX200 continued to climb adding 0.5% in July.

- Sector Performance – Materials (+5.8%), IT (+4.6%) & Communication Services (+3.4%) sectors outperformed.

- Global – in the US the S&P500 index rose 5.6% in July after a 1.8% jump in June and 4.8% in May.

- Gold – continued its strong rise to another all time high of $1,964.90/oz, an increase of over $196 in the month of July.

- Iron Ore – rose to $109.50/ton from $103.20/ton in June.

- Oil – rose to US$43.30/bbl as at the end of July.

Property

- Housing – dwelling prices dropped 0.8% in July nationally. Sydney was down 0.9% while Melbourne was down 1.2% in July

- Values –Sydney dwelling values are still 4.4% below the July 2017 peak while Melbourne is still 3.5% below the July 2017 peak. Interestingly ACT (Canberra) property values rose 0.6% in July to an all time record high.

- Home Sale Trends – homes are taking longer to sell, increasing from 43 days on average in the March quarter to 45 days in the June quarter and now 49 days in the 3 months to the end of July.

- Auction Clearance Rates – dropped to 55.9% in July from 58.9% in June. This compares to clearance rates of about 80% in the first half of 2017.

- Dwelling Approvals – declined a further 4.9% over June to 12,213; the lowest volume of approvals since July 2012.

- Housing Finance – in May, the portion of new housing finance to investors fell to a record low of 25%.

Economy

- Interest Rates – were left on hold at 0.25%.

- CPI – June quarter inflation collapsed down 1.9%, the largest fall in the 72 years history of data collected by the ABS. Annual inflation has been running below the RBA’s 2-3% target band for a period of 24 straight quarters.

- Retail Sales – jumped again in June by 2.7%m/m. The level is now 7% above the February 2020 pre COVID level. Online sales are a massive 72% higher than a year ago.

- Bond Yield – Australian 10-year Government bond yields were 0.82% while US Government 10-year bond yields dropped only 10 bps to 0.55%.

- Consumer Confidence – the ANZ Roy Morgan weekly consumer confidence index fell to 89 at the end of July. This represents a 4% decline in the month if July and a massive 18% decline since mid-February.

- Exchange Rates – the Australian Dollar rose against the US Dollar to 0.71 (from 0.693 in May) a rise of over 2 cents.

- Unemployment – rose to 7.4%. in June, a 22 year high.

- Chicago Purchasing Managers Index (PMI) – having fallen for 11 straight months to 32.3 in May and jumped to 36.6 in June, the Chicago PMI jumped strongly to 51.9 in July well above the 50 level indicating a growing economy, despite the obvious problems of COVID, BLM and the upcoming November 3 election.

- German Factory Orders – jumped a huge 27.9% in June but are still 11.3% lower than in February this year before COVID restrictions were put in place. June’s result was strong evidence of rising levels of demand within the German economy.

- UK Economy – contracted 2.2% in GDP terms in the first quarter of 2020; the largest drop since 1979.

- Chinese Economy – grew by 3.2% in the second quarter of 2020 to June 30. This was a strong rebound from the massive 6.8% contraction in the first 3 months of the year following COVID 19 lockdown restrictions.

Sources: UBS, Westpac, S&P Dow Jones Indices, ABS, US BLS, CoreLogic, Morningstar.

Comment – Fishing Wars & Food Security

There was a very interesting article in one of the mainstream papers recently on the increasing international tensions over fishing rights. The cause of these tensions is again something that Australia takes for granted, food security. In this case it was a serious altercation between our most populous northern neighbour Indonesia and the main instigator of aggression in the South China Sea being China. The incident which occurred in December last year did not get wide scale press in Australia due to the severity of the bushfires that were ravaging large parts of Australia. China had sent a fleet of 63 commercial fishing vessels with 4-armed coast guard vessels as escort into Indonesia’s Exclusive Economic Zone in an area known as the Natuna Sea.

In Indonesia, fish accounts for more than 50% of total protein intake and the fishing industry employs some 12 million people. The loss of fisheries for such countries could contribute to violent extremism, political instability and potentially even large-scale population movements. The scale to which these 63 commercial fishing vessels could deplete Indonesia’s fish stocks is obvious and as a country of 268 million people who have genuine food security issues, this event was met with an iron fist.

President Joko Widdodo instructed the Indonesian Navy, several coast guard vessels, its own commercial fishing vessels and four F-16 fighter jets to repel the insurgent Chinese fleet.

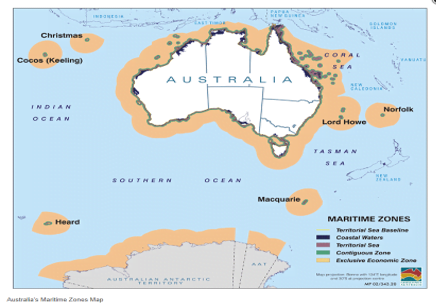

Australia is blessed with a relatively small population sitting on a massive land mass of 7.7million square kilometres with a massive 59,736 kilometres of coastline. The control the Australian government has extends well beyond our immediate coastline. Australia’s “Exclusive Economic Zone” extends 200 nautical miles (370km) beyond the coastline and is regulated by the United Nations Convention on the Law of the Sea or UNCLOS.

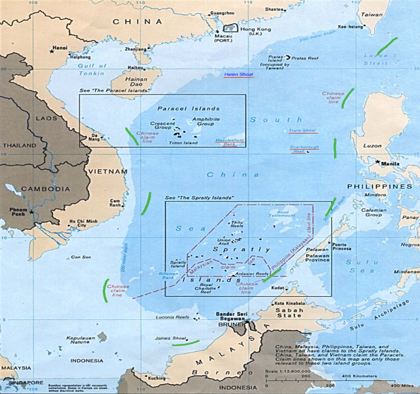

When the same 200km EEZ is applied in the South China Sea, things get a little vague. With Japan, China, Vietnam, Malaysia, Taiwan, Thailand, Singapore, The Philippines, Brunei, and Indonesia all having rights to a defined 200km EEZ, and given the importance of the sea as a commercial shipping route, fishing industry and undiscovered oil & gas reserves, all bordering countries are sensitive to any incursions. In 2009, in a submission to the United Nations, China lodged a map of the South China Sea with a vaguely defined 9 dash line, which comprised most of the area and overlapped with the legitimate EEZ boundaries of the other coastal countries in the region.

The major islands and reef formations, being the Spratly Islands, Parcel Islands, the Natuna Islands and Scarborough shoal, have in the last 10 years become the target of significant Chinese development with land reclamation, key military infrastructure development, and troop deployments. In a report to congress titled US-China Strategic Competition in South & East China Seas: Background & Issues for Congress on 23rd June 2020, it noted “Chinese domination over or control of its near-seas region could help China to do one or more of the following on a day-to-day basis:

- control fishing operations and oil and gas exploration activities in the South China Sea (SCS);

- coerce, intimidate, or put political pressure on other countries bordering on the SCS;

- announce and enforce an air defence identification zone (ADIZ) over the SCS;

- announce and enforce a maritime exclusion zone (i.e., a blockade) around Taiwan

The US is concerned that China’s actions will challenge the existing principle of peaceful resolution to disputes between the affected nations and that it opposes the “might makes right” approach which China is adopting.

Fishing rights is the first and obvious issue for many of the surrounding countries. With China’s almost insatiable demand for fish and the South China Sea accounting for 15% of the global catch in 2015, control and exploitation of these seas is critical. 59 million people work in the fishing or aquaculture industry with 85% of those in Asia according to United Nations Food & Agriculture Organisation, and over 3.5million fishing vessels, the pressure on the fish stocks in the South China Sea is enormous and possibly unsustainable. With fishing boundaries tied to agreed geopolitical boundaries, and endorsed by UNCLOS, the actions by China in the region could be concern for all.

China of course does not limit itself to the South China Sea. It has raised the ire of many African nations as well as South America while here in Australia, where we have the prized Southern Blue Fin Tuna, illegal fishing is also very actively defended. China has a very small Exclusive Economic Zone relative to their population and in recent times have increasingly looked at other geographic fishing grounds to fill their growing need for fish protein. In this regard Indonesia’s actions against China in December can be seen as being resolute in the defence of international law and is but another significant issue the world faces in these challenging times.