Income Support and the Coronavirus Supplement

Over the last couple of weeks, we have seen many businesses shutdown or change how they trade. This has resulted in large amounts of people either being made redundant or temporarily stood down without pay.

To assist many of these people throughout this period, the Government has provided the following income support to individuals who may be affected by this:

- Temporarily expanding the eligibility criteria for JobSeeker income support payments.

- Temporarily increasing the amount your partner can earn before your entitlement to the job seeker payment is lost.

- Establishing the time-limited Coronavirus supplement.

This information has been collated from the Federal Treasury Factsheets along with information from Services Australia (Centrelink) and we hope will be of assistance to you should you find yourself or someone you know in a position where they may require income support.

Expanded Eligibility Criteria

There are two forms of income support available for JobSeekers:

- Youth Allowance for job seekers for those aged 16 to 21; and

- JobSeeker Payment for those aged 22 to Age Pension Age.

The Government has temporarily expanded the eligibility criteria by:

- Expanding the groups of people who are eligible to apply

- Waiving the assets test for the next 6 months.

- Waiving the liquid assets waiting period

We have focussed the information below on the JobSeeker Payment.

We also note that if you are eligible for additional support payments this should increase your entitlement.

Who is Eligible?

Generally, to be eligible for either of these payments you must be either:

- Unemployed and looking for work; or

- Sick and temporarily unable to work for a short period of time.

The Government has temporarily expanded this to also include:

- Those who are stood down or lose their employment

- Casual workers

- Sole traders

- The self-employed

- Contract workers

When Will I Get It?

Another temporary change the Government has made is to waive the one week waiting period and the liquid assets test.

Ordinarily there is a minimum one week waiting period, and this is normally extended if you have savings or other money (the liquid assets test) that you could arguable live off for a period of time.

From 25 March 2020, the liquid assets test will not apply until such time as the Government deems.

Do I Still Have to Look for Work?

The Government has altered the mutual obligation requirements so that these can be undertaken flexible and safely.

These obligations will be tailored to your circumstances and reviewed regularly. These obligations will consider the need to self-isolate should you come into contact with a person infected with the Coronavirus.

Under these mutual obligation requirements, you must have a job plan and will most likely be required to review this regularly with an Employment Services Provider.

The Assets Test

Ordinarily if your assets are higher than the asset limits you will not receive any entitlements regardless of what your income is. This test has temporarily been waived.

This will mean that you should receive your first payment in the first payment cycle after your application has been approved. Centrelink will advise you of this date via your Centrelink online account as part of the application approval process.

Coronavirus Supplement

Over the next six months, the Coronavirus supplement of $550 per fortnight will be paid to all existing and new recipients of the following payments.

- JobSeeker Payment 1

- Youth Allowance JobSeeker

- Parenting Payment (Partnered and Single)

- Farm Household Allowance

- Special Benefits recipients

- There is no scaling of this payment, provided you are entitled to receive some of one of the above payments, you will receive the full $550 per fortnight.

The payment of the supplement will commence from 27 April 2020.

1. This also includes all payments that are transitioning to the JobSeeker Payment including Partner Allowance, Widow Allowance, Sickness Allowance and Wife Pension)

How Much Will I Get?

How much JobSeeker payment you receive will depend on the following:

- Whether you are single, partnered and/or have children

- How old you are

- How much income you earn

- How much income your partner earns

- Whether you are eligible to receive any other support payments such as rent assistance.

Details of all payments can be found at here.

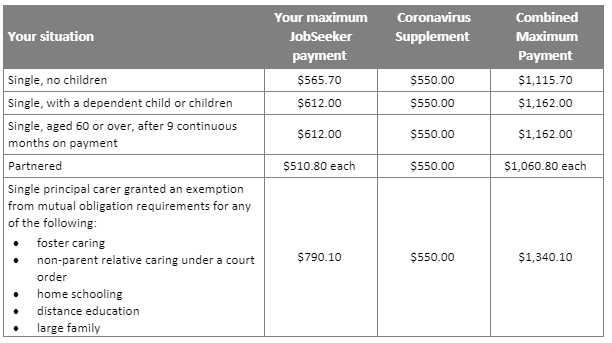

Maximum Fortnightly Entitlement

The maximum amount of JobSeeker Payment you can receive fortnightly is detailed in the table below. This may be increased by other entitlements such as Rent Assistance, Pharmaceutical Allowance and Family Benefits. The Coronavirus supplement of $550 is paid in addition to these payments. These amounts are before tax. Centrelink will withhold tax as required from these payments.

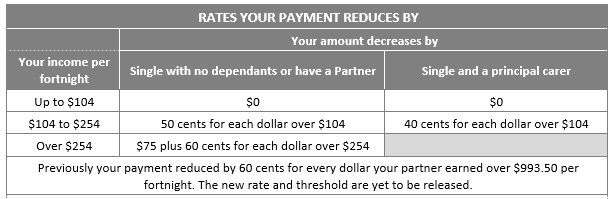

Impact of Other Income

Your JobSeeker payment will decrease depending on:

- how much other income you earn per fortnight; and

- how much your partner earns per fortnight.

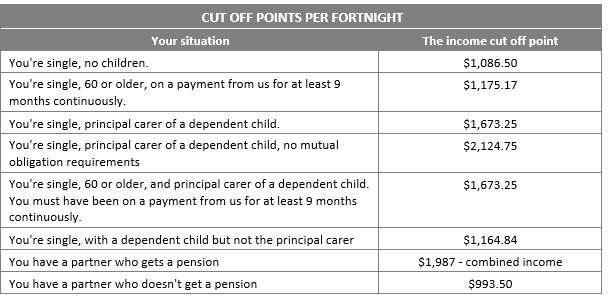

These rates are detailed in the tables below. We have also included the published fortnightly income cut off at which you will no longer receive the job seeker payment.

You will need to report your income to Centrelink fortnightly via your Centrelink online account. This income includes wages, salary sacrificed super, rental income, dividends and other investment income.

If you think you are on the borderline of being eligible, we recommend that you apply to Centrelink. They will assess your situation and advise whether you are entitled.

You may find that as your other income, or your spouse’s income, may vary from fortnight to fortnight that your entitlement will change from week to week.

Singles

For singles, whilst the Assets test is waived:

- An adult who is single with no dependents earning less than $104 per fortnight will receive the full JobSeeker payment.

- An adult who is single can earn up to $1,086.50 per fortnight before they do not receive any JobSeeker payment.

Couples

For couples, it is a little more complicated as you must consider the income that is earned by both spouses.

Step 1: Assess your partner’s income. Provided your partner earns less than $3,068 per fortnight ($79,762 p.a.) you may be entitlement to the JobSeeker payment. You will also be entitled to the Coronavirus supplement of $550.

Unfortunately, at the date of writing this, the Government is still to release the temporary rate and thresholds at which your partner’s earnings will impact your entitlement.

Step 2: Assess your income. The thresholds for your income are the same as for a single, i.e. you can earn up to $104 per fortnight before your entitlement starts to reduce and the rate it reduces increases after you earn $254 per fortnight.

Rates and Cut-off Points

How to Apply

Given the current social distancing requirements, the Government is requesting that you make your claim online wherever possible.

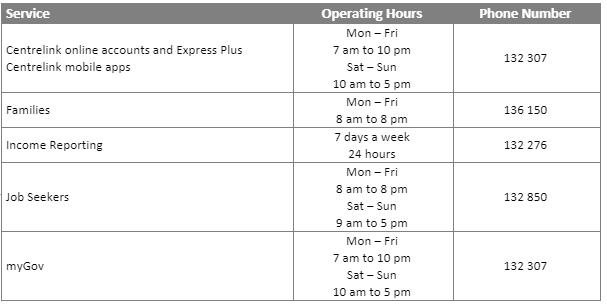

If you have any problems claiming online, you can call them on the Job seekers line on 132 850 or go to your local service centre. Please note that due to the high volume of applicants there may be significant wait times on both the phone line and at the local service centre.

Detailed instructions on how to apply can be found here:

You will need a myGov account and a Centrelink online account. Instructions on how to set these up can be found at:

NOTE: To setup and link your Centrelink online account you will need your Customer Reference Number (CRN) and you may need to confirm your identity. If you do not have, or cannot find, your CRN you will need to call Centrelink.

Once you have submitted your claim, Centrelink will provide you with a transaction receipt which will allow you to track the progress of your claim. This receipt will also provide you with an estimate of when your claim is complete. Centrelink will notify you of the result of your claim by sending a letter to your myGov inbox. You can also elect to have your mail sent electronically.

You can track the progress of your claim online by logging into myGov and going to Centrelink.

If Centrelink requires additional information, they will provide you with details of the information they require.

You can also keep track and access your mail via the Express Plus Centrelink mobile app.

Centrelink Contact Numbers

We have summarised the main JobSeeker numbers below. Please click here for a full list of Centrelink phone numbers.

Sources

Services Australia, JobSeeker: https://www.servicesaustralia.gov.au/individuals/job-seekers

Treasury Factsheet for individuals: Fact_sheet-Income_Support_for_Individuals_0