Retailers on Short Notice for New Penalty Rates from 1 November 2018

In a decision released on 27 September 2018, the Fair Work Commission (Commission) has made changes to penalty rates for all retail employees covered by the General Retail Industry Award 2010 (Award). The changes will apply from 1 November 2018.

The Commission’s review of the Award has distinguished between the purpose of casual loadings and penalty rates and their decision has been made to ensure that the Award provides a “fair and relevant minimum safety net of terms and conditions”.

Going back to fundamentals, the purpose of the casual loading is to compensate casual employees for the fact that they are not entitled to sick leave or annual leave. Whereas penalty rates are intended to compensate employees for the inconvenience associated with working late nights, weekends and at odd hours.

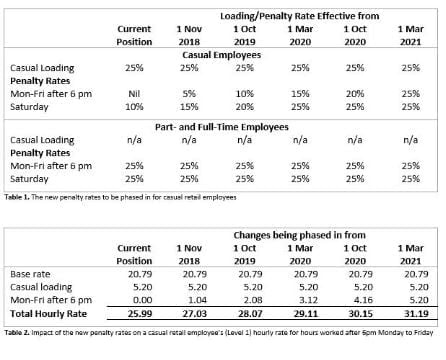

The Commissioner has determined that penalty rates should be increased for casual employees in line with the penalty rates received by part- and full-time employees for hours worked after 6pm Monday to Friday and for all hours worked on Saturdays. The rates will be increased over three years as per the table below. The penalty rates are received in addition to the 25% casual loading and are outlined in Table 1.

Table 2 below illustrates the change in the hourly rate for a casual retail employee (Level 1) with the changes to the Mon-Fri after 6pm penalty rate.

In the same decision, the Commissioner has also decreased the penalty rates for shift workers.

Sunday penalty rates will still undergo the staged reduction as per the Productivity Commission report into workplace relations from earlier this year.

We expect that news of the decision is sure to cause headaches for retail businesses in the lead up to Christmas as the unbudgeted changes hit their bottom line as they scale up their workforce in preparation for the busiest time of year in retail. Furthermore, many small businesses will remain ignorant of the change for some time to come and inadvertently underpay their employees.

Gift cards

In Australia, around 34 million gift cards are sold each year with an estimated value of $2.5 billion. On average, an estimated $70 million is lost because of expiry dates.

Applying from 1 November 2019, new laws are in effect that introduce a regime for the regulation of gift cards including:

- A minimum 3 year expiry period

- Bolstering disclosure requirements, and

- Banning post-supply fees.

What business needs to do

From 1 November 2019, businesses should ensure:

- All gift cards have a minimum three year expiry period. Any existing gift card stock should be run down and production reviewed to ensure that once the new regime comes into effect, only compliant gift cards are issued.

- Ensure disclosure requirements are met. The expiry date or the date the card was supplied and a statement about the period of validity must be set out prominently on the gift card itself. For example, if the supply date was December 2019, “Supply date: December 2019. This card will expire in 3 years,” or “Valid for 3 years from 12/19”. It is assumed that the card expires on the last day of the month where only the month and year are displayed. If the gift card does not expire, the card will need to clarify this by stating words to the effect of, “never expires”.

- Post-supply fees are not charged. A post-supply fee is a fee that is charged reducing the value of the gift card such as administration fees for using a gift card. Post-supply fees exclude the fees that are normally charged regardless of how someone pays for a product or service. For example, booking fees, a fee to reissue a lost or damaged card, and payment surcharges.

A number of larger businesses have adopted a 3 year expiry period following the introduction of NSW laws. These include David Jones, Myers, Westfield, Rebel Sport, Coles, and Dymocks. Other retailers have no expiry dates including iTunes, JB Hi-Fi, EB Games, Woolworths and Bunnings. Generous expiry periods are a point of difference when consumers are working out which retailers gift card to purchase.

What happens if a business ignores the new rules?

Once the new rules come into effect, if a gift card is supplied with less than a three year expiry period, the disclosure requirements are not met, or post-supply fees are charged, a penalty may be imposed of up to $30,000 for a body corporate and $6,000 for persons other than a body corporate. In addition, the ACCC has the ability to impose infringement notices. Each infringement notice is 55 units (currently $11,500) for a body corporate and 11 units (currently $2,420) for persons other than a body corporate.

What happens if a business becomes insolvent or is sold?

The consumer’s rights do not change if the business becomes insolvent or bankrupt. The consumer becomes an unsecured creditor of the business.

If a business changes owners, the new owner must honour existing gift cards and vouchers if the business was:

- sold as a ‘going concern’. That is, the assets and liabilities of the business were sold by the previous owner to the new owner.

- owned by a company rather than an individual, and the new owner purchased the shares in the company.

Santa Issues

An anti-social media Christmas party

Most businesses have a good understanding of the impact of alcohol, sexual harassment, bullying and anti-social behaviour at Christmas parties.

It’s a good time to remind employees that the staff Christmas party is considered to be the workplace and they need to protect the reputation of the company.

Gift giving

Gifts for employees need to be kept below $300 per person. The Tax Office consider it to be a minor benefit and as such, exempt from FBT. Gifts above this level are deductible to the business but FBT will apply.

If the gift is for a client, gifts are deductible as long as the gift is given by the business with the expectation that the business will benefit (ie. the gift is given with the expectation of generating revenue).

Spreading the joy – entertaining clients

Entertaining your clients at Christmas is not tax deductible. So, if you take them out to a nice restaurant, to a show, or any other form of entertainment, then you can’t claim it as a deductible business expense and you can’t claim the GST credits either.

Clause with a cause

Charity gifts are an increasingly popular form of corporate giving. For tax purposes, you can only claim a tax deduction for donations made to deductible gift recipients (DGRs). If you or your client receive anything for the donation, then it’s not tax deductible because you have purchased something rather than made a donation.

Tax rate reduction for small business

Small business is still a vote winner with the Government and Opposition teaming up to accelerate tax cuts for the sector by 5 years impacting on an estimated 3.3 million businesses.

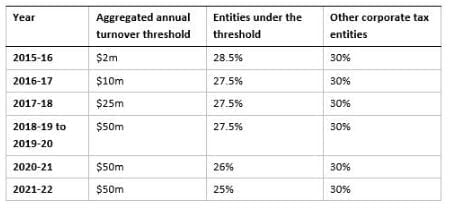

Parliament recently passed legislation to accelerate the corporate tax rate reduction for corporate tax entities that are base rate entities (BREs). Under the new rules:

- A 26% rate will apply to BREs for the year ending 30 June 2021, and

- A 25% rate will apply to BREs from 1 July 2021.

The amending legislation also increased the small business income tax offset rate to 13% of an eligible individual’s basic income tax liability that relates to their total net small business income for the 2020-21 income year and 16% for the 2021-22 income year onwards.

The problem for franking credits

The company tax rate changes have also impacted on the maximum franking credit rules.

In 2015-16, the first year small business entities could access a reduced company tax rate of 28.5%, the maximum franking credit rate for franked dividends remained at 30%. However, from the 2016-17 income year onwards the maximum franking credit rate needs to be determined on a year-by-year basis. In many cases this means that if the company’s tax rate is 27.5% then the maximum franking rate will also be 27.5%. However, this will not always be the case.

Quote of the month

“Live as if you were to die tomorrow. Learn as if you were to live forever.”

Mahatma Gandhi