Funding for the arts: what’s available and how can you get it

Will the Prime Minister’s targeted $250 million package of funding to support cultural and creative projects and initiatives save the industry?

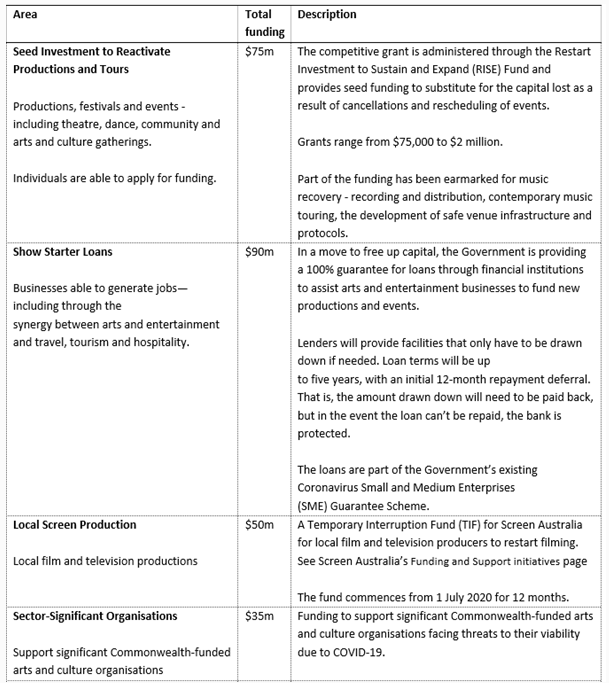

The arts funding is aimed at kick starting the sector with funding preferencing commercial initiatives that generate jobs and are expected to have a positive economic impact. That is, this is an economic package as opposed to creative or cultural funding.

Outside of the funding package, SupportAct received $10m in funding for COVID-19 crisis relief grants. Crisis funding is accessible to:

- musicians, crew and music workers who are unable to access Government benefits due to eligibility or other issues

- music workers who have been able to access Government benefits but are still facing financial hardship; and to

- those who are suffering financial hardship as a result of injury, ill-health or a mental health issue that is managed through a current Mental Health plan.

To be eligible, you will need to be a musician, crew or music worker, who:

- is an Australian citizen, permanent resident or have a valid working visa

- can prove they been working in the music industry for three years

- can provide names and details of two professional referees

- have household expenses greater than household income.

Other financial support is available through JobKeeper (including the self-employed) or JobSeeker.

For more details see The Office for the Arts COVID-19 update.

For many in this sector, the funding is helpful but the future will be determined by how quickly or otherwise the distancing measures are retracted. After all, most entertainment relies on a crowd.

JobKeeper and termination payments

An employment termination payment (ETP) is a lump sum payment made to an employee when their job is terminated. ETP’s are generally made up of unused sick leave or unused rostered days off, payment in lieu of leave, genuine redundancy payments, etc.

For some employers, JobKeeper will not be enough to keep the employee employed. If you do need to let staff go, the ATO has stated that from JobKeeper fortnights from 8 June onwards until the end of the scheme, ETPs cannot be included as part of the $1,500 an employer needs to pay to eligible employees to access JobKeeper payments.

If any JobKeeper payments include an ETP to a terminated employee between 30 March to 7 June, the ATO has stated that it will not recover an overpayment.

Minimum wage increases by 1.75%

An increase to the minimum wage of 1.75% will start rolling out for the first full pay period from 1 July 2020.

The increase applies to minimum rates in awards in 3 stages:

Group 1 Awards – from 1 July 2020

- Frontline Heath Care & Social Assistance Workers

- Teachers and Child Care

- Other Essential Services

Group 2 Awards – from 1 November 2020

- Construction

- Manufacturing

- A range of other industries

Group 3 Awards – from 1 February 2021

- Accommodation and Food Services

- Arts and Recreation Services

- Aviation

- Retail

- Tourism

You can find the full list of impacted Awards on the Fair Work Ombudsman’s website.

For anyone not covered by an award or an agreement, the new national minimum wage of $753.80 per week or $19.84 per hour, applies from the first full pay period starting on or after 1 July 2020.

The minimum wage increase does not impact on workers receiving above the minimum wage.

For employees at or close to the minimum wage, it is essential that employers are aware of the impact and timing of the increase to avoid falling foul of their industrial and superannuation obligations.

The new flexible Parental Leave Pay rules

From 1 July 2020, parents accessing the Government’s parental leave pay (PPL) scheme will have greater flexibility and options.

Targeting the self-employed and small business owners, the changes introduce a new flexible paid parental leave pay period of 30 days.

Previously, new parents could apply for PPL for a continuous block of up to 18 weeks. The changes split this time period into two:

- A continuous period of up to 12 weeks, and

- 30 flexible days.

Parents can take the 18 weeks in one block or, under the new rules, take the 12 week period and then use the additional 30 days at a period and in a way that suits them but before the child turns 2 years of age. For example, assume that when Jane, who works five days per week, has a child, she initially claims 12 weeks. Jane returns to work part time for three days per week. In that case, Jane would apply to be paid parental leave pay on the two days per week that she is not working.

The administration of the PPL will change in some scenarios. For Jane’s case above, the employer would administer the scheme for the first 12 weeks but then the Government would directly pay Jane for her flexible days.

If an employee wishes to access flexible parental leave pay, they will need to negotiate time off work or a part time return to work with their employer. If the employer is unable to accommodate the request, then the employee may take the 18 weeks as one block.

The changes to the paid parental leave scheme apply to babies born on or after 1 July 2020. The scheme commences from 1 April 2020 to give parents applying for leave the flexibility to use the new arrangements (but only if their child is born on or after 1 July 2020).