Overview

With revisions to the Age Pension assets test just around the corner, it’s important to understand how the changes could impact you. These thresholds are the value of assets you can own (excluding your home) before you lose eligibility for the Age Pension.

Under the changes to the assets test, effective 1 January 2017, it is expected that more than 50,000 additional Australians will receive the full Age Pension. Meanwhile, roughly 300,000 retirees on the part pension will have their entitlements reduced, with about 100,000 people losing all entitlements.

The current and post 1 January 2017 Asset Test thresholds are below:

Full-pension Thresholds

| Full Pension | Current Asset Limit | 2017 Asset Limit |

| Non-homeowner (single) | $360,500 | $450,000 |

| Non-homeowner (couple) | $448,000 | $575,000 |

| Homeowner (single) | $209,000 | $250,000 |

| Homeowner (couple) | $296,500 | $375,000 |

Note: these lower thresholds are indexed each year in July.

Part-Pension Thresholds

| Part Pension | Current Asset Limit | 2017 Asset Limit |

| Non-homeowner (single) | $945,250 | $742,500 |

| Non-homeowner (couple) | $1,330,000 | $1,016,000 |

| Homeowner (single) | $793,750 | $542,500 |

| Homeowner (couple) | $1,178,500 | $816,000 |

Note: these upper thresholds will be indexed twice per year in March and September.

How Will the Changes Affect You?

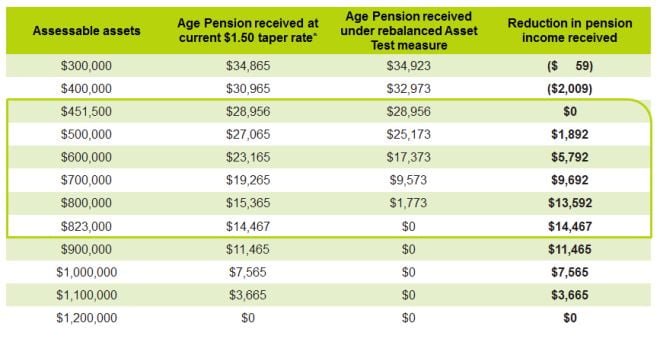

The below tables demonstrate the impact point and effect on your age pension entitlements as calculated by the Asset Test.

Couple – Home Owners

Single – Home Owners

Upside to Losing Your Benefits

People who lose their Age Pension in 2017 as a result of the changes will automatically be entitled to receive a Commonwealth Senior’s Health Card (CSHC) and/or a Low Income Health Care Card (LIHCC). These cards will provide access to things such as Medicare bulk billing and less expensive pharmaceuticals.

If you lose the Age Pension but receive the CSHC or LIHCC, your entitlement is grandfathered. This means that you will not be means tested for these cards and hence will hold these for life.

What Next

- Centrelink will write to you between now and Christmas advising you of the impact to your Age Pension.

- To ensure you receive your correct Age Pension benefit check that your Assets are correctly recorded with Centrelink. You can do this by logging into your MyGov account (if you have one), calling Centrelink on 13 23 00 or visiting your nearest Centrelink branch.

- If you are close to the cut off limits, planning could be undertaken to reduce your assessable assets and enable you to keep your Age Pension. If you are interested in exploring this option please contact our office and organise an appointment.