The most recent budget has noted some important changes to the superannuation environment. We felt it was high time to encourage you to review your circumstances and be aware how the below changes may affect you.

Employer Reminders

In the current financial year the minimum rate of Superannuation Guarantee Contributions (SGC) you need to contribute on behalf of your eligible employees is 9%. This percentage begins to increase from 2013 (see article below).

SGC you make for your employees must be made on at least a quarterly basis. (see lodgement period table below).

Keep in mind that to claim a tax deduction for SGC in the last quarter (1st April to 30th June) in this financial year, the contributions must be received by the employee’s superannuation fund by 30th June 2012.

If the superannuation fund receives the SGC contribution after this date, the tax deduction for these contributions cannot be claimed until the following financial year.

Important Note: Please be mindful when making employees contributions. By making 5 quarters of superannuation payments in one financial year you may cause your employee to exceed their contribution cap leading to excess contributions tax payable.

It is also worth mentioning that the payslips you provide to your employees need to detail which superannuation fund you are paying into and the total contribution made. Payslips should be given to your employees on their pay date.

| Lodgement | Period |

|---|---|

| 28th July | 1st April – 30th June |

| 28th October | 1st July – 30th September |

| 28th January | 1st October – 31st December |

| 28th April | 1st January – 31st March |

SGC – Increase for Employers in 2013

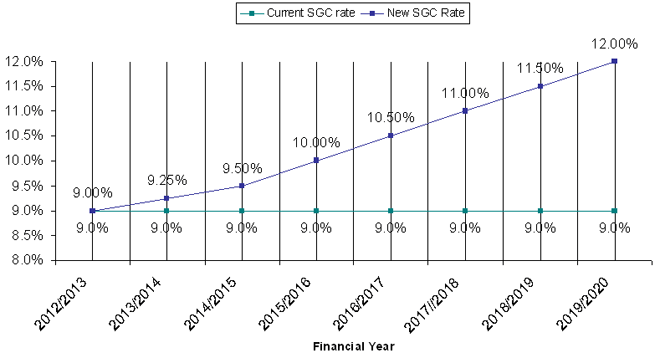

It has been known for sometime that the Government intended to increase the Superannuation Guarantee Contributions (SGC) rate in increments over the next 7 years to 12%.

If you are an employer you should prepare yourselves for the 2013/2014 financial year where you will be required to increase your employee’s SGC to 9.25%. This is in increase of 0.25% from the current rate of 9.00%.

Good news for mature workers: from 1 July 2013 the maximum age limit for receiving SGC will also be abolished. Up until this date the current age limit of 70 will still apply.

The incremental SGC increases are as follows:

Over 50s – Concessional Cap Reduced to $25,000

After much debate and speculation about whether our Government would maintain the higher concessional contributions cap at $50,000 for people over age 50, as is currently the case, the Government has deferred this action for two financial years until 2014.

Therefore from 1 July 2012 the concessional contributions cap for all individuals will be $25,000, regardless of age.

If you are over 50 and have been taking advantage of the higher concessional contributions cap, you need to review your circumstances now to ensure you do not exceed this cap in the 2012/2013 financial year. Remember that this cap includes all employer contributions including Superannuation Guarantee and Salary Sacrifice Contributions.

There are hefty tax penalties for exceeding the concessional contributions cap and this is an outcome you should avoid.

Pension Payments – Drawdown Relief Extended

Pensioners can continue to breathe easy as the Government has extended the minimum pension drawdown relief for the 2012/2013 financial year. This relief will remain at 25%, with it forecast to be discontinued in the 2013/2014 financial year.

You should continue to review your pension income needs and ensure that you are drawing an appropriate amount. This is especially important for those of you that are members of a self managed superannuation fund.

Remember that the minimum pension drawdown is also dependant on your age and if you are moving into a higher age bracket that your minimum pension drawdown will increase. You should review this to ensure that you are drawing only what you need.

The minimum pension drawdown factors for the 2012/2013 financial year, in comparison to the base minimum, are shown below:

| Pensioner Age Bracket | Base Minimum (2013/2014) | 2012/2013 |

|---|---|---|

| Under 65 | 4.00% | 3.00% |

| 65 -74 | 5.00% | 3.75% |

| 75 – 79 | 6.00% | 4.50% |

| 80 – 84 | 7.00% | 5.25% |

| 85 – 89 | 9.00% | 6.75% |

| 90 – 94 | 11.00% | 8.25% |

| 95 and over | 14.00% | 10.50% |

Individuals Earning Over $300,000

High income earners have suffered a blow from the recent budget, as from 1 July 2012 individuals who earn over $300,000 in a financial year will pay 30% tax on concessional contributions to superannuation. This is an additional 15%, with the current level being 15%.

Income for this purpose will be defined to include taxable income, concessional super contributions, adjusted fringe benefits, total net investment losses, foreign income and tax-free government pensions and benefits less child support payments.

This may reduce the tax effectiveness for some high income earners, although savings can still be achieved compared to marginal tax rates.

The tax effectiveness of superannuation in 2012/2013 for people at various income ranges is shown below:

| Taxable Income | Marginal Tax Rate (excl Medicare levy) | Super Contributions Tax Rate | Tax Saving on Concessional Contributions |

|---|---|---|---|

| Under $18,200 | 0% | 15% (but will be refunded) | 0% |

| $18,201 – $37,000 | 19% | 15% (but will be refunded) | 19% |

| $37,001 – $80,000 | 32.5% | 15% | 17.5% |

| $80,001 – $180,000 | 37% | 15% | 22% |

| $180,001 – $300,000 | 45% | 15% | 30% |

| $300,000+ | 45% | 30% | 15% |

Unlicensed Accountants Cannot Give Super Advice

From 1st July 2012, the ‘accountant’s exemption’, a rule that allows accountants to give self managed superannuation fund advice without holding an Australian Financial Services Licence, will be removed.

Self managed superannuation funds are a specialised area as we believe that receiving advice from an unlicensed person is unwise and could negatively impact the effectiveness of your retirement planning strategies. You would only seek the services of a licensed plumber so why should your superannuation be any different.

This new legislation does not affect our clients as we have licensed advisers that can provide you with sound self managed superannuation fund advice.

For those of you that have an accountant that does not hold an Australian Financial Services Licence and you have a self managed superannuation fund, we can provide advice going forward to assist you achieve your retirement goals. Contact us for more information.