Markets

Local: For November, the ASX 200 fell by 0.92% although there were some big variances across the sectors: Materials were +6% while Energy was -8.4%, the biggest drag at the index level were the financials which fell by 8%.

Global: The S&P 500 posted a loss of 1% through November, outperforming mid and small-caps, as the S&P MidCap 400 and the S&P SmallCap 600 declined 3% and 2%, respectively.

Gold: Spot price for Gold remained stable at $1,804.40.

Iron Ore: Iron Ore dipped to $100 per metric ton as China`s industrial production growth continued to slow.

Oil: Crude Oil fell slightly m/m closing at US $81.49 per ton. The price has risen 90.89% over the past 12 months.

Property

Housing: Australian housing values were 1.3% higher in November marking the 14th consecutive month where CoreLogic’s national home value index recorded positive value growth. The November update takes national housing values 22.2% higher over the past 12 months, adding approximately $126,700 to the median value of an Australian home.

Although values are continuing to rise, the November result was the softest outcome since January when values rose 0.9%. Since a cyclical peak in the rate of growth in March, when housing values rose at 2.8%, there has been a notable trend towards milder price growth. Virtually every factor that has driven housing values higher has lost some potency over recent months. Fixed mortgage rates are rising, higher listings are taking some urgency away from buyers, affordability has become a more substantial barrier to entry and credit is less available.

Economy

Interest Rates: RBA Cash rate remained unchanged at 0.10%.

GDP: Due to recent lockdowns, real GDP dropped 1.9% over the previous quarter. However, it is only 0.2% below the pre-pandemic peak in Q4-2019.

Household Savings: The household savings ratio spiked far more than expected over the previous quarter hitting 19.8% after 11.8% previously. This is set to boost future spending on the economy re-opening.

Bond Yields: Australian government 10-year bond slipped from last month to 1.79%, whilst the US 10-year bond increased to 1.63%.

Exchange Rate: The Aussie dollar fell against both the American dollar, at $0.714, and the Euro at $0.627 respectively.

Consumer Confidence: The Westpac-Melbourne Institute Index of Consumer Sentiment increased by 0.6% to 105.3 in November from 104.6 in October. Firstly, the level of the Index is almost identical to the level just over a year ago in October 2020 (105.0) and has remained steady over the last two months despite both Sydney and Melbourne having moved out of their hard ‘delta’ lockdowns since September.

Agriculture: Winter crop production in Australia is forecast to increase by 5% in 2021–22 to a record 58.4 million tonnes. Production is expected to be a record high in Western Australia and the second highest on record in New South Wales and Queensland. Production in Victoria and South Australia is expected to be well above average. The December forecast is a 6.6% upward revision from the forecast ABARES published in the September 2021 edition of Australian Crop Report.

Employment: The current unemployment rate has crept up to 5.2% a 60 bps increase from the previous reported figure of 4.6%. Underemployment figures also rose slightly hitting 9.5%. Youth unemployment also rose dramatically m/m from 10.8% to 13.1%.

US Employment: The current unemployment figure stands at 4.6%, with the biggest improvement coming from males over 20 years of age falling by 0.4%.

Purchasing Managers Index: The Australian Industry Group Australian Performance of Manufacturing Index (Australian PMI®) rose by 4.4 points to 54.8 points, indicating improvement in average activity levels across manufacturing in November (seas. adj). This was the first month of improvement following three months of flat results for the Australian PMI®. Results above 50 points indicate expansion, with higher results indicating a faster rate of expansion.

Sources:ABS, AFR, Deloitte Access Economics, RBA, UBS, Westpac

Comment

Is Wage Growth Holding Back Our Rate Hikes

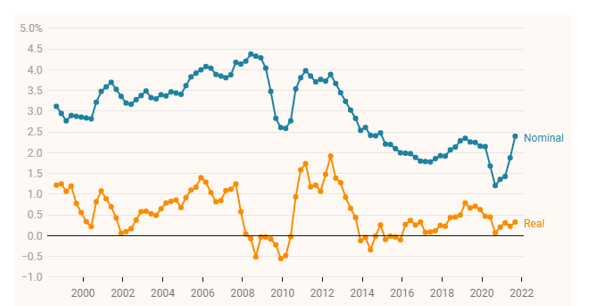

Despite the last year providing the strongest private sector wages growth for nearly seven years, as construction and professional industries deal with a labour shortage due to the pandemics restrictions and government housing stimulus, we are still seeing wages growth struggle to keep up with inflation.

The latest wages growth figures reported by the bureau of statistics showed private sector wages haven’t risen at this pace since 2014. Yet while sitting at the 2.4% mark they are still more than a 100 basis points below the RBA`s target of 3.5%. Some of the figures may start to look promising but the real-wages growth data does show for some dismal reading. Even though nominal wages have jumped, real wages continue to lag behind.

While notionally we are back at pre-pandemic wage growth, the pandemic still remains to be the main driver for that growth. Government housing stimulus programs have led to surges in construction which put pressure on construction wages as potential builders are looking for work. Other industries such as the professional, scientific and technical services are also clambering for more workers, not so much due to a surge in demand for their services but because border closures have kept skilled foreigners from being able to fill them. Despite certain scenarios causing wages growth to rise, the annual 2.4% growth only looks strong because the past decade has been so weak in comparison, with 34 consecutive quarters of sub-3% wages growth. Once sectors return back to normal with the reopening of our economy it is expectant that wages growth in these sectors will once again moderate. A pre-pandemic mindset that wages growth needs to be tampered with will keep wages growth to a minimal. Music to the ears of RBA`s Phillip Lowe whose relentless dovishness on both wages and monetary policy may be vindicated by such news.

During November the RBA reinstated their stance that there will be no interest rate increases in 2022 and has repeatedly said that they will not be expecting a wage breakout like that of the US or UK, where wage costs are rising at more than 4%. The current lagging behind in our wages growth is one of the main reasons why our core inflation rate is also significantly behind our AUKUS counterparts.

Currently only 10% of the labour market is capturing growth anywhere near the RBA`s current wages target. With construction, professional services and hospitality currently above 2.5%; the reasons stated earlier. Showing how far off we really are. Phillip Lowes main scepticism for any rate increases in the near future is our poor wages growth over the last decade, he does not believe that wages growth can accelerate fast enough to seriously rationalise any rate increase in 2022. It has been reiterated that usually you would incur persistently higher inflation with higher wages growth, the two generally go together. This would suggest that the labour market really is the key to unlocking our inflation rate target.

In recent weeks lenders have started to take matters into their own hands by increasing their lending rates and in hand tightening their own financial conditions, separate to the RBA. By doing this they may have released some of the pressure that that is currently heaped onto Phillip Lowe to raise interest rates in the short term.

Sources: ABS, AFR

The Global Energy Crisis

Crude oil hit $83 USD per barrel showing a 65% increase this year. Gasoline prices have also reached its highest level last month since 2015 at 1.27 USD/ Litre. Even coal is exploding with prices reaching US$269 recently a 400% increase. This energy boom is feeding into the inflationary loop, which in turn is pushing the prices up for energy-intensive metals such as steel and iron ore.

What has caused this? – It started when the global economy was tanking as the first and second waves of COVID-19 infected hospital systems and fuel production was curtailed as activity fell to a stop.

Then China banned Australian coal and tried to resupply this shortage from Indonesia, Russia and Mongolia but supply bottlenecks left inventories at 10 year lows and in-turn caused a huge surge in prices. Unfortunately, just how the whole pandemic started China continues to be the global problem. Since the GFC, Chinas phenomenal growth and huge stimulus programs have kept the economic powerhouse steaming ahead. Becoming the world factory and producing large amounts of manufactured goods. While also keeping prices down.

That’s now come to a grinding halt. China’s overblown property market is teetering, threatening a serious financial crisis and credit squeeze. Chinese real estate group Evergrande’s slow implosion is now spreading through the entire mainland property sector. That’s hit just as the country may be forced to drastically wind back its industrial production. With China not likely to change their political stance with the Australian government, coal imports may continue to be sparce over the winter months. On the other hand despite this Australia’s export earnings have held up well.

According to Citigroup, the coal and power crunch is likely to persist through the northern hemisphere winter, forcing the government to order at least a 12% cut in industrial power use in the next few months. If the winter is particularly harsh, the cuts could be greater just to ensure there’s enough fuel for basic heating. This could increase the possibility of stagflation risks and growth pressures on the Chinese and global economy over the coming months and push energy prices even higher. Right now, there is furious debate about how to deal with this. Money markets again are convinced central banks will be forced to raise interest rates much sooner than expected.

But that could spell disaster. As government debt has soared with pandemic support and developed world household debt rising exponentially as property values escalate, central banks may well find they have their hands tied. There’s no point raising interest rates if everyone is going to be bankrupted.

President Biden has come out recently willing to do whatever it takes to help curtail this energy price storm. This would mean releasing reserves and putting pressure on the big oil companies and petrol producers abroad. This all in an effort to stay away from a 1970`s style fuel crisis. In what must be the ultimate irony, given US President Joe Biden is leading the push for lower carbon emissions and to remove coal from electricity generation, American power plants are on track to burn 23 per cent more coal than last year. But by not tackling this problem now, inflation will get out of control and possibly even unemployment levels. Last week’s release of oil from the nation’s Strategic Petroleum Reserve is Bidens short-term political choice to make his long-term policy decisions possible. Instead of asking people to change their wasteful ways to beat back inflation, Biden believes it is the government’s job to solve big problems and relieve pain. It’s an effective political strategy that may also smooth the transition away from fossil fuels and help Americans plan for a better future. Only time will tell how successful this policy will be and 2022 looks like it will be another bumpy ride ahead for our most needed commodities.

Sources: AFR, Citigroup