The 2020/2021 Federal Budget sees a record $213.7 Billion deficit and net debt predicted to peak at $966 Billion (44% GDP) by June 2024.

The Government is lowering taxes and increasing spending with a focus on low/middle income earners, small business, senior Australians and transport infrastructure.

Unemployment is predicted to peak at 8% in December 2020 and with the Government focus on growing the economy and creating jobs, and will hopefully reduce to 6.5% by June 2022.

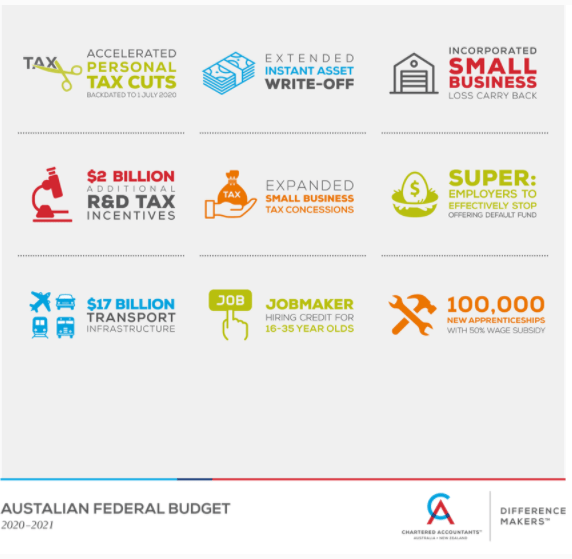

Key Initiatives

The key initiatives of the 2020-21 Federal Budget are listed below with further detail provided after our summary.

The Budget also contains two additional Economic Support payments of $250 to pensioners and other eligible welfare recipients to drive money back into the economy.

By comparison to many, Australia has managed the COVID-19 pandemic well, but good management isn’t enough to protect us from the $213.7 billion deficit in 2020-21. The Government has taken to heart the old adage, “You have to spend money to make money” to trade our way out of a black hole.

Some of the measures are aimed at addressing the harsh lessons COVID-19 has taught us and seek to centralise production back in Australia to ensure our industries can be self-reliant.

Outside of the big ticket tax measures, what is striking about this Budget is the sheer volume of initiatives it funds – too many to itemise in this update. Many of the initiatives aim to improve how Government interacts with the community and business in particular. This funding is focussed on streamlining interaction and compliance with Government requirements and investing in the IT infrastructure required to digitise the compliance process.

The final comments in the Treasurer’s Budget speech paint a cautionary tale. The focus right now is on the path to growth and stabilising debt in an effort to boost consumer and business confidence. However, once “recovery has taken hold and the unemployment rate is on a clear path back to pre-crisis levels” of below 6%, the second phase will kick in – the deliberate shift from providing temporary and targeted support to stabilising debt.

Accelerated Personal Tax Cuts

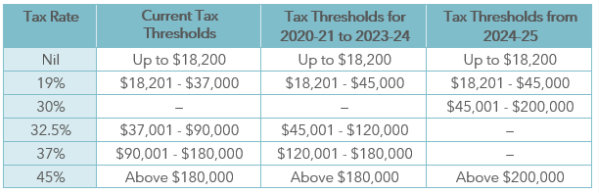

The Government has brought forward planned income tax cuts by two years at a cost of $17.8 billion.

The tax cuts will be backdated and come into effect from 1 July 2020.

In addition, the low- and middle- income tax offset (LMITO) which provides a reduction in tax of up to $1,080 for individuals with a taxable income of up to $126,000 will be retained for 2020-21.

The Low- income tax offset (LITO) will increase from $445 to $700.

In 2020-21, low- and middle- income earners will receive tax relief of up to $2,745 for singles, and up to $5,490 for dual income families compared to the 2017-18 settings.

Extended Instant Asset Write-Off

The Government is really keen for business to invest and have extended and broadened the access to the Instant Asset Write-Off.

Previous COVID measures had temporarily increased the Instant Asset Write-Off threshold to $150,000 per asset for all assets purchased and installed ready for use prior to 31 December 2020. The new measures have removed this cap, extended the period to which it applies and increased the number of businesses that have access to the write-off.

This means that from 7:30pm AEDT 6 October until 30 June 2022 businesses with a turnover up to $5 billion will be able to deduct the full cost of eligible depreciable assets upfront rather than being claimed over the asset’s life.

For businesses with turnover up to $50 million, the extended write-off also applies to second-hand assets.

Eligible businesses that acquired new or second hand assets under the existing $150,000 threshold will also have an extra six months (to 30 June 2021) to first use or install those assets.

Small Business Loss Carry Back

Companies with turnover up to $5 billion will be able to carry back losses from the 2019-20, 2020-21 and 2021-22 income years to offset previously taxed profits in the 2018-19, 2019-20 and 2020-21 income years. This will generate a refundable tax offset in the year in which the loss is made.

The tax refund will be available on election by eligible businesses when they lodge their 2020-21 and 2021-22 tax returns.

If a company does not elect to carry back losses they will continue to carry losses forward as normal.

This measure will interact with the Extended Instant Asset Write-Off as new investment in assets may generate significant losses in some cases which can then be carried back to generate cash refunds for eligible companies.

Additional R&D Incentives

The Government has injected an additional $2 billion into the Research and Development system through the Research and Development Tax Incentive (R&D tax offset).

For small claimants with turnover less than $20 million, the refundable R&D tax offset will increase and there will be no cap on annual cash refunds.

For larger claimants with turnover greater than $20 million, the intensity test will be streamlined and the non-refundable R&D tax offset will be increased.

For all claimants, the R&D expenditure threshold will increase from $100 million to $150 million per annum.

These changes will apply from 1 July 2021.

Expanded Small Business Tax Concessions

Announced pre Budget, a range of generous tax concessions normally only available to small and medium businesses, will be available to businesses with a turnover of up to $50 million.

The expanded concessions will be rolled out in three phases:

Phase 1: from 1 July 2020

- Immediate deduction for certain start-up expenses such as professional, legal and accounting advice as well as statutory fees.

- Immediate deduction for prepaid expenditure where the payment is for a period of services which is 12 months or less and ends in the next income year.

Phase 2: from 1 April 2021

- FBT car parking exemption will apply on certain car parking benefits provided to employees

- FBT exemption on portable electronic devices that are mainly used for work use such as phones and laptops.

Phase 3: from 1 July 2021

- Simplified trading stock measures allow a business to elect not to conduct a stock take where there is a difference of less than $5,000 between the opening value of trading stock and a reasonable estimate of the closing value of trading stock at the end of the income year.

- PAYG Income Tax Instalments can be calculated using a GDP adjusted amount based on the last reported income instead of as a percentage of instalment income.

- Settle excise duty and excise-equivalent customs duty monthly instead of weekly.

- Two-year amendment period to income tax assessments, excluding entities that have significant tax dealings or particularly complex affairs.

- Simplified accounting method and reporting for GST purposes.

Super reforms

Superannuation accounts ‘stapled’ to an individual

This reform will ensure individuals continue to use their existing superannuation fund when they change jobs. The fund will be “stapled” to the individual to prevent the duplication of superannuation fund accounts when changing employers.

From 1 July 2021:

- If an employee does not nominate an account at the time they start a new job, employers will pay their superannuation contributions to their existing fund.

- Employers will obtain information about the employee’s existing superannuation fund from the ATO.

- The employer will do this by logging onto ATO online services and entering the employee’s details. Once an account has been selected, the employer will pay superannuation contributions into the employee’s account.

- If an employee does not have an existing superannuation account and does not make a decision regarding a fund, the employer will pay the employee’s superannuation into their nominated default superannuation fund.

The Government expects that future enhancements will enable payroll software developers to build systems to simplify the process of selecting a superannuation product for both employees and employers through automated provision of information to employers.

Accountability of underperforming funds

From July 2021, the Australian Prudential Regulation Authority will conduct benchmarking tests on the net investment performance of MySuper products, with products that have underperformed over two consecutive annual tests prohibited from receiving new members until a further annual test shows they are no longer underperforming.

If a fund is deemed to be underperforming in the first of these annual tests, it will need to inform its members of its underperformance by 1 October 2021. When funds inform their members about their underperformance they will also be required to provide them with information about the YourSuper comparison tool (see below). Underperforming funds will be listed as underperforming on the YourSuper comparison tool until their performance improves.

Non-MySuper accumulation products where the decisions of the trustee determine member outcomes will be added from 1 July 2022.

Performance transparency

A new interactive tool (YourSuper) will enable a comparison of simple super (MySuper) products ranked by fees and investment returns. The tool will also provide links to other MySuper products and show current super accounts if the individual has more than one.

The tool will be administered by the ATO.

Trustee accountability

The obligations on superannuation trustees will be strengthened to ensure their actions are consistent with members’ retirement savings being maximised. By 1 July 2021:

- Superannuation trustees will be required to comply with a new duty to act in the best financial interests of members.

- Trustees must demonstrate that there was a reasonable basis to support their actions being consistent with members’ best financial interests.

- Trustees will provide members with key information regarding how they manage and spend their money in advance of Annual Members’ Meetings.

Transport Infrastructure Spend

Infrastructure investment announced in the Budget now totals $14 billion in new and accelerated projects over the next four years. The projects are expected to support 40,000 jobs during their construction.

There is also an additional $3 billion for small scale road safety and the Local Roads and Community Infrastructure Program supporting a further 10,000 jobs. Funding will be provided to state and local governments on a ‘use it or lose it’ basis.

$2.7 billion of this infrastructure spend has been allocated to NSW projects. Key investments include:

- $560 million for the Singleton Bypass on the New England Highway

- $360 million for the Newcastle Inner City Bypass between Rankin Park and Jesmond

- $120 million for the Prospect Highway Upgrade

- An additional $491 million for the Coffs Harbour Bypass taking the total contribution to $1.5 billion.

And, for those that catch the train each day to work, there are upgrades planned for commuter carparks along the North Shore to St Marys (T1), and the T8 East Hills Line at Campbelltown, Revesby and Riverwood.

JobMaker Hiring Credit

The JobMaker Hiring Credit will be available to eligible employers over 12 months from 7 October 2020 for each additional new job they create for an eligible employee.

Eligible employers will receive:

- $200 per week if they hire an eligible employee aged 16 to 29 years or

- $100 per week if they hire an eligible employee aged 30 to 35 years.

The JobMaker Hiring Credit will be paid quarterly in arrears. It will be available for up to 12 months from the date of employment of the eligible employee with a maximum amount of $10,400 per additional new position created.

Employers will need to demonstrate that the new employee will increase overall employee headcount and payroll.

To be eligible, the employee will need to have worked for a minimum of 20 hours per week, averaged over a quarter, and received the JobSeeker Payment, Youth Allowance (other) or Parenting Payment for at least one month out of the three months prior to when they are hired.

New Apprenticeships and Trainees

Announced pre Budget, from 5 October 2020 a business (or Group Training Organisation) that takes on a new Australian apprentice will be eligible for a 50% wage subsidy, regardless of geographic location, occupation, industry or business size. The scheme will be available until the 100,000 cap has been reached.

Under the subsidy, employers will be eligible for up to 50% of the wages of a new or recommencing apprentice or trainee for the period up to 30 September 2021. The maximum subsidy is $7,000 per quarter.

The subsidy is paid in arrears and is available for wages paid from 5 October 2020 to 30 September 2021.

Eligible businesses are those that:

- Engage an Australian Apprentice between 5 October 2020 and 30 September 2021, and

- The Australian Apprentice or trainee is undertaking a Certificate II or higher qualification, and has a training contract that is formally approved by the state training authority.