Introduction

On Tuesday 2 April 2019, the Treasurer, Josh Frydenberg, released the Government’s 2019-20 Budget featuring a forecast return to surplus, accelerated income tax cuts and a range of measures centred on election-friendly promises. We outline the key announcements in the Budget for your information.

It’s important to remember that the Budget announcements are still only proposals at this stage. Each of the proposals must be passed by Parliament before they’re legislated.

Personal Income Tax Cuts

The Government has announced it will extend the personal income tax cuts that were announced in last year’s Federal Budget. This is proposed to be achieved as follows:

- From 1 July 2018 to 30 June 2022 – increase the Low and Middle Income Tax Offset (LMITO) from a maximum of $530 to $1,080 ($2,160 for dual income families). The LMITO (which is in addition to the Low Income Tax Offset) will be received after individuals lodge their tax return for the relevant income years.

- From 1 July 2022 – the upper threshold for the 19% tax bracket will increase from $41,000 to $45,000, and the LITO maximum amount will increase from $645 to $700. The increased LITO will be withdrawn at a rate of 5 cents per dollar between taxable incomes of $37,500 and $45,000. LITO will then be withdrawn at a rate of 1.5 cents per dollar between taxable incomes of $45,000 and $66,667.

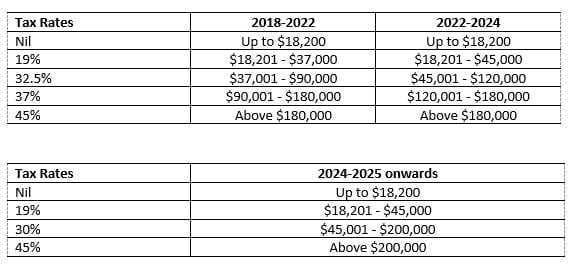

From 1 July 2024, the 32.5% marginal tax rate will be reduced to 30%. The 37% tax bracket will also be abolished as per the Government’s already legislated plan. The proposed marginal tax rates and thresholds are as follows:

Tax – Small Business

Small Businesses Tax Cuts

The government is fast-tracking planned tax cuts for small and medium businesses by five years. The tax rate will come down from 27.5% to 26% next year and 25% starting in 2021.

Fast-tracking the tax cuts will benefit around 970,000 companies that employ around 5.2 million workers.

Increase and Expand Access to the Instant Asset Write-off

Effective 2 April 2019 to 30 June 2020

Effective 2 April 2019 to 30 June 2020 the Government is proposing to increase and expand access to the instant asset write-off from Budget night until 30 June 2020. These changes are in addition to a measure announced on 29 January 2019 that is currently before Parliament and is yet to be legislated.

The Government announced two changes in the Budget:

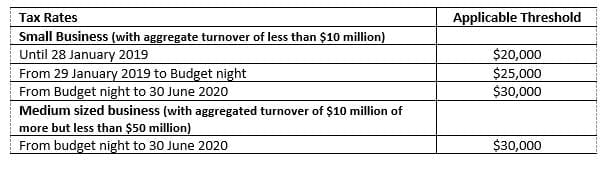

- increasing the instant asset write-off threshold from the proposed $25,000 to $30,000 for small businesses (with aggregated annual turnover of less than $10 million)

- expanding the instant asset write-off measure to medium sized businesses with aggregated annual turnover of $10 million or more, but less than $50 million.

This means both small businesses and medium sized businesses can immediately deduct purchases of eligible assets costing less than $30,000 that are first used, or installed ready for use, from Budget night to 30 June 2020. Medium sized businesses must also acquire these assets after Budget night to be eligible as they have previously not had access to the instant asset write-off.

The $30,000 threshold applies on a per asset basis. This means eligible businesses can instantly write off multiple assets.

Arrangement prior to Budget night (2 April 2019)

Prior to Budget night, the Government had legislated to extend the existing $20,000 instant asset write-off for small businesses (with aggregated annual turnover of less than $10 million) to 30 June 2019.

On 29 January 2019, the Government made a further announcement to increase the instant asset write-off threshold for small businesses from $20,000 to $25,000 from 29 January 2019 to 30 June 2020. A Bill containing this measure is currently before Parliament and is yet to be legislated.

These changes interact with the changes announced as part of last night’s Budget. This means that, when both measures are legislated, the below instant write-off thresholds apply to small businesses:

Superannuation

No work test for voluntary contributions extended to age 66

Effective 1 July 2020 the Government will amend the superannuation contribution rules to allow people aged 65 and 66 to make voluntary contributions to superannuation without meeting the work test. This will align the work test with the qualifying age for Age Pension (scheduled to reach 67 from 1 July 2023).

Under current legislation, for a client aged 65-74 to be eligible to a make a voluntary superannuation contribution they must have already satisfied the work test during the financial year the contribution is made. The work test is satisfied where a client has been gainfully employed 40 hours in a period of 30 consecutive days during the financial year. Alternatively, from 1 July 2019 clients may instead satisfy the work test exemption to make voluntary contributions.

Voluntary contributions are all contributions other than employer contributions required under Super Guarantee law or an industrial award or agreement (ie. mandated employer contributions). Voluntary contributions that require the work test to be satisfied include:

- personal after tax (non-concessional) or tax-deductible (concessional) contributions

- voluntary employer contributions (e.g. salary sacrifice that is not counted towards the employer’s SG obligations)

- spouse contributions made by the member’s spouse on their behalf.

Bring-forward rule extended to age 66

Effective 1 July 2020 people age under 67 at any time during a financial year (e.g. 65 and 66 year old’s) will be able to trigger the non-concessional bring-forward rule.

Currently, clients must be under age 65 at any time during a financial year to trigger the bring-forward rule. The bring forward rule allows client to make up to three years’ worth of non-concessional contributions, which are capped at $100,000 a year, to their superannuation fund in a single year.

Spouse contributions extended to age 74 effective 1 July 2020

Currently, to be eligible to make a spouse contribution, the receiving spouse must be under age 70 at the time of the contribution and must meet the work test if they are between age 65 to 69.

Under the proposed changes, spouse contributions can be made where the receiving spouse is under age 75. In addition, where the receiving spouse is age 65 or 66 they no longer need to meet a work test. A receiving spouse will need to meet the work test from age 67.

Protecting Your Super Package –Putting Members’ Interests First

Effective 1 October 2019 the Government has introduced a Bill to give effect to contentious elements of the Protecting Your Super measures which were excised from the original Bill (which has already been legislated).

These measures have been introduced in the Treasury Laws Amendment (Putting Members’ Interests First) Bill 2019.

In summary, this Bill proposes to prohibit trustees from offering insurance on an opt-out basis for:

- new members under the age of 25 who open an account on or after 1 October 2019, and

- members with balances less than $6,000. These measures are proposed to commence on 1 October 2019 if successfully legislated.

Social Security

Energy Assistance Payment

Effective by 30 June 2019 social security pension recipients will receive a one-off Energy Assistance Payment by the end of the current financial year.

The payment will be $75 for singles and $125 for couples combined and will be exempt from income tax.

People who are Australian residents and eligible for the following payments as at 2 April 2019 will automatically receive the payment – Age Pension, Disability Support Pension, Carer Payment and Parenting Payment Single. Also, recipients of the following payments from the Department of Veterans Affairs will be eligible -Service Pension, Income Support Supplement, disability payments, War Widow(er)s Pension, and permanent impairment payments under the Military Rehabilitation and Compensation Act 2004 (including dependent partners) and the Safety, Rehabilitation and Compensation Act 1988.

Reporting Employment Income -Single Touch Payroll

Effective by 1 July 2020 the reporting of employment income for social security purposes will be automated through Single Touch Payroll (STP).

Under the current system, income support recipients who are employed are required to calculate and report their earnings on a fortnightly basis.

Under the proposed changes, employment income will be reported through an expansion of STP data-sharing arrangements to include the Department of Human Services, for recipients with employers utilising STP.

The Government states this measure will assist income support recipients by reducing the likelihood of receiving an overpayment of income support payments.

The Government will achieve savings of $2.1 billion over five years through more accurate reporting of employment income.

Other Spending Incentives

Infrastructure Spending

The government has increased its infrastructure investment to $100 billion, with fast rail planned to connect Melbourne to Geelong.

It will also investigate the feasibility of fast rail connecting Sydney to Newcastle, to Wollongong and to Parkes (via Bathurst and Orange), Melbourne to Albury, to Shepparton or Traralgon and Brisbane to Moreton Bay and the Sunshine Coast or to the Gold Coast.

In NSW, hundreds of millions will be allocated to the M1 Pacific Motorway, the Princes Highway and Western Sydney Rail.

Struggling Farmers

There’s a lot of cash for regional areas, particularly farmers who are struggling with drought and floods.

A total of $6.3 billion is committed to helping them. That includes relatively large initiatives, such as $200 million to increase access to income support, and smaller ones, such as a $2.5 million increase in funding to support farmers’ mental health and wellbeing.

And to safeguard against future droughts and floods, the government is spending $3.9 billion to create an Emergency Response Fund, which will provide a stable source of money to prepare for and react to natural disasters.

Health

There’s lots of money going towards health and mental health including $308.9 million for improving the accessibility of services like x-rays and ultrasounds.

Out-of-pocket costs for these scans will also be reduced and the costs of some medications will also be reduced.

Five drugs have been amended or added to the Pharmaceutical Benefits Scheme (PBS) and two lifesaving drugs used to treat Hereditary Tyrosinaemia Type-1 and Batten Disease will be available for free.

A grants program to improve outcomes for Australians living with chronic disease will be established, there’s money for diabetes research, and the government has a $5 billion Medical Research Fund to go towards clinical trials and other research.

When it comes to mental health, about $229.9 million over seven years will be provided. This will help fund the trial of eight mental health centres.

About $6.1 million will be provided for the establishment of Grace’s Place, a residential trauma recovery centre for children, and $5 million for a purpose-built Repatriation General Hospital in Adelaide to help people with eating disorders.

Another $263.3 will be provided from 2018/19 to improve access to youth mental health services.